by Dan Sullivan

When it comes to personal finance, the internet is well loaded with tips, even without having to pay to access them.

However, the Personal Finance subreddit is filled with interesting and helpful advice. And they are potent enough to guide you in your financial concerns.

Contents

Below are 5 best threads you should equip yourself with that I've found in the community.

With a compass, navigating becomes easier.

No doubt, the Personal Finance subreddit is full of fascinating and useful recommendations.

The first word after the line of the headline on this thread is "welcome". Just as you know, if you are not acknowledged to be considered welcome or accepted into a circle, you might get kicked out, if not sidelined from accessing the benefits therein.

So this thread waste no time in guiding you on what to engage your money and also cautions so that you are not chased out of the community in term of violating the does and don'ts of the space.

With other extended links under this thread, like the weekday help where you get to follow up with people's most recent experiences and learn from them. Likewise, the weekend discussion and victory link also expose you to updates on weekend days, those that haven't been active during the weekdays tend to update on the happenings around them for others to learn or asking engaging questions.

Advice and tips for different age brackets are also not left out for a pleasurable moment while surfing through the thread.

You can also check out 5 things rich people do with money or 7 smartest things you can do for your finances, to further expose you to more information on how to handle your money.

Since one of the things we all do with money is - spend it. This simple but seemly cunny act, if not curtained, can be hazardous to your financial health. This is why stumblepretty had to be a savior to you, sharing through his personal experience, how you can get rid of unorderly spending manner. This he engaged in curbing his spending addiction. Here are a few tips from his share how to:

This is a profound point to me, that he said, explaining using my own words, it means asking yourself of the possible thing you could have used the money you want to spend, to get instead that could be of more importance to what you intend going for.

You can read up the rest.

Also, a piece of key advice was made in the comment box, stating that you should not save credit card information on online shopping websites. In order not for your outsider budget expense to sneak in from behind.

Another tip that was shared also is, putting your savings safely a bit far from your reach, in order for you to stick to your budget, and not get tempted to pick it for something outside the list of your budget.

5 steps on how to prepare a budget are also available on Reddit Personal Finance for you to exercise with. And it will benefit you in coming up with an effective budget.

You can even pay the sacrifice of working with this full month Challenge of practical budgeting also on Reddit Personal Finance that begins with you tracking all you spending for the whole days of the month.

Among the numerous positive effect, the 30-days challenge will make on your finance are this few listed

· Awareness of excessive spending on junks

· Track your missing monies

· Expose to you on how un-wise you have been with your money

· Get acquainted with other people's experiences that you can learn

NOTE:

Money loves to be spent, mostly on pleasures and wants, which is why you must learn to tame its desire, so you don't get hurt in return.

You can also consult YNAB on Reddit for more guide in tailoring a budget plan that fits you. Mint is also a good place to consult for budgeting. Perhaps you can equally take a time out on YouTube to check this simple trick with over 4.6M viewers on how to save a lot of money:

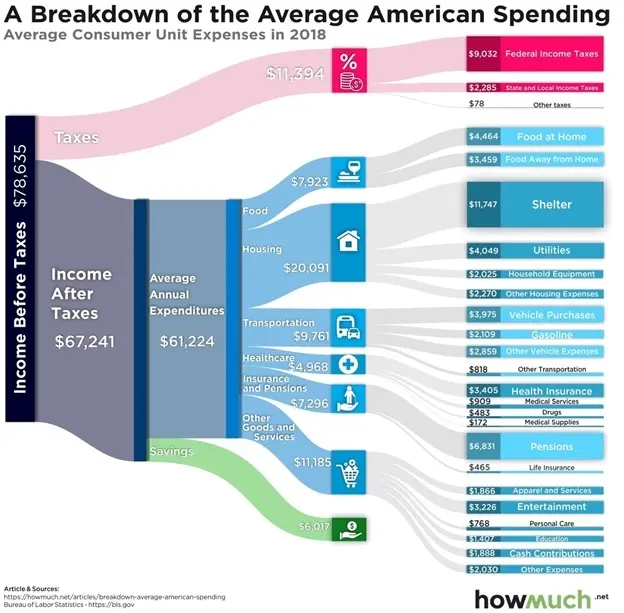

The infographics below also hint on what the average American spending spread across.

Investing has been a big concern to many. How to invest? What to invest in? For how long should I invest? Along with other like-minded questions - burdens many hearts. What you don't know, you will be at the mercy of it. Investing is not really a major challenge since we have a lot of people succeeding in it. This means if we seek rightly, we will get what is right for us.

A few things on the chart list of content on Reddit Personal Finance that you will find interestingly useful are:

Ø Is it ideal to invest money that I will need back within a short period of time?

Ø which accounts are best to recommend to save in?

Ø Any suggestions on what I can invest in?

Ø How I do begin investing for retirement?

Ø can I invest a huge sum all at once, or try a dollar-cost mean plan?

Ø How do I put my 401(k), 403(b), SIMPLE IRA, or other employee benefits to yield more money for me?

Ø Can I get a tailored package that will be extremely specific for me to begin with? Etc.

You can equally watch a man of refutable success - Warren Buffet:

Likewise, a glimpse captions covering investing is pictured in the graphic below.

How do you respond especially along the area of your finances if you lose your loved one to death? This thread on Reddist personal finance provides a whole lot of answered questions that may never have crossed your mind. Though the OP centers around cash portfolios and estate challenges fantastically, it conjointly goes into the additional lesser-identified elements of managing death, like wherever to induce associate degree urn:

Generally, it's a good browse for anyone - even though you may not have gone through any personal calamity. It's a wonderful exposition on living, death, and wherever our finances take side with.

You can equally check out what to do when a loved one dies. Since death is inevitable to all.

And though one may not wish for it towards a dear one, this could avert some unpleasant happenings if you plan ahead.

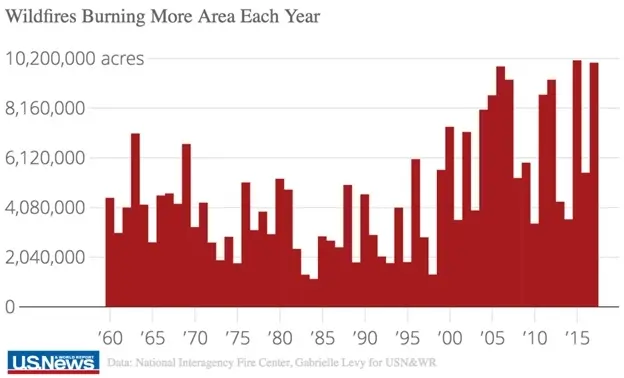

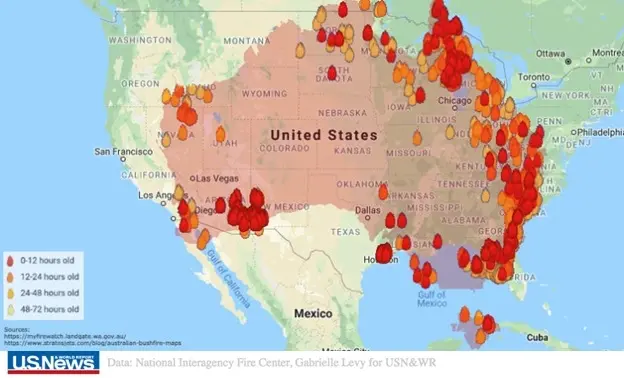

I just have to include this thread, with the increasing fire outbreak each year around us.

Sometimes we have a tendency to do all we will to stop disaster - however it winds up happening anyway.

Understudy thread : referencing this OP on Reddit Personal Finance, on losing everything you own in an exceeding fire occurrence.

There are a lot of insightful things shared on this understudy thread:

vInsurance cover

vAnalyzing loses

vImportance of keeping inventory your possessions

vTaking a yearly stock of everything in your house. Etc.

This thread highlights the huge task when something insurance-related is involved.

Even with the Australia experience, where the lives of human beings and animals were claimed by the flame, one needs to take necessary action ahead for a possible shielding so as not to be stranded if otherwise occurred.

The graph below also shows a wildfire burning statistic in the USA. And the one below it, pictured on the map of the areas that suffered fire outbreaks.

I will leave with you a mindset check, that if you fix yourself with the right spot, you will experience a positive change in your personal finances.

Here I go!

There are 3 basic things people do with money. And we can make a grouping of people under 3 categories based on this usage of money.

Basic things people do with money

And under the 3 categories of people, we have:

Therefore, I advise you to mount on the train of the wise concerning how you deal with money and arrive in the realm of great fortune.

About Dan Sullivan

Dan Sullivan is a renowned professor and esteemed education writer with a passion for inspiring students and transforming the field of education. With a diverse background in academia and practical teaching experience, he has become a leading figure in educational research and pedagogy.

|

|

|

|

Check These Out

Let's get FREE Gifts together. There're other Freebies here

AdBlock now to see them all. Click a button below to refresh

|

|

|

|