by Dan Sullivan

Getting a good investment account where you can keep your funds and watch it increase Is quite challenging. Investing is commonly seen as a task that is overwhelming, most especially for young investors. Thankfully, investing services and online brokers have made it feature rich, easy, profitable and low cost management services. Opting for multiple or one of these services can assist you to become more relaxed and confident about investment. You can also gain useful and new insights, and at the same time increase your wealth. Experienced investors that are looking for investment planning services of low cost, have lots of available options. It is important that you find the right service for your particular financial situation because, there is continued entry of financial advisors with different service range.

Contents

Today we will be looking at some of the best investment accounts for young investors.

Looking to grow or increase your money Through investing? then wealthfront is the right choice for you. Wealthfront which was established in 2011 is a financial management service. It specializes in automated investment planning and offers credit for clients of brokerage account.

Account features and tools

Contents

The working principle of wealthfront is quite simple. The minimum amount needed to invest on this platform is $500 and when you make an investment of $500, the money is kept at Royal Bank in Canada. The amount invested is then allocated to several traded funds, which are of low cost, covering about 11 asset classes which excludes foreign, corporate, municipal, and real estate.

Pricing and fee

minimum required account value is $500 and the Minimum amount that can be withdrawn is $250 . 0.25% is the annual fee for account under $9,999 Some provisional offers may give you free account management for the initial $5,000 deposited. The annual fee for all amounts over $5,000 is 0.25%. Features

· Retirement savings

· Referral program

· Tax harvesting at stock level

· External account management

· Line of credit on investment bigger than $10,000

· Cash account with interest rate of 2.57%

The principle of wealthfront makes it a great investment service which does well in taxable accounts. For young investors and beginners, wealthfront offers a viable option and you can reduce the expenses that are related to yearly taxes. It is important for active investors to have a supplementary self directed investment account.

This is an investment planner that was established in 2008. It operates exclusively for customers in the United States. It offers a low fee for account management and portfolios that are easy to personalize. Betterment is maintained in order by the financial industry regulatory authority (FINRA). It's a technology assisted portfolio and the pioneer in automated investments. Betterment provides aids with the required facility to purchase an advice pack which is fully customized or assistance with human advisor over the phone. For customers who finds the professional financial advisor fee too high, and for those who don't have the basic skills in asset allocation or investing money. An automated financial accounts like this platform offers a great option.

Account features and tools

The betterment account can be employed in several ways. All your financial accounts can be synchronized and even get the entire asset outlook and without investing. You can decide to invest in portfolios that betterment provides. The portfolios provided by betterment are very flexible which allows you to personalize based on your requirements. Betterment taxable account offers a max tax returns. This is due to the harvesting method.

Pricing and fees

Two major pricing plans are offered by Betterment which are; the Premium and Digital plans. The yearly fee of the Digital plan is 0.25% plus the facility to receive and send messages to financial experts through its application, retireguide, and rebalancing. For accounts of more than $100,000, the Premium plan is used and it has an annual fee is $0.40 . It also include CFP calls, investment assistance and messaging through the application.

Features

· Low management fee

· Account is a digital account, fast and easy to set up

· Transparent portfolio

· Customize portfolio

· Betterment app and financial advice packages

· Automatic deposits

· Socially responsible investment portfolio.

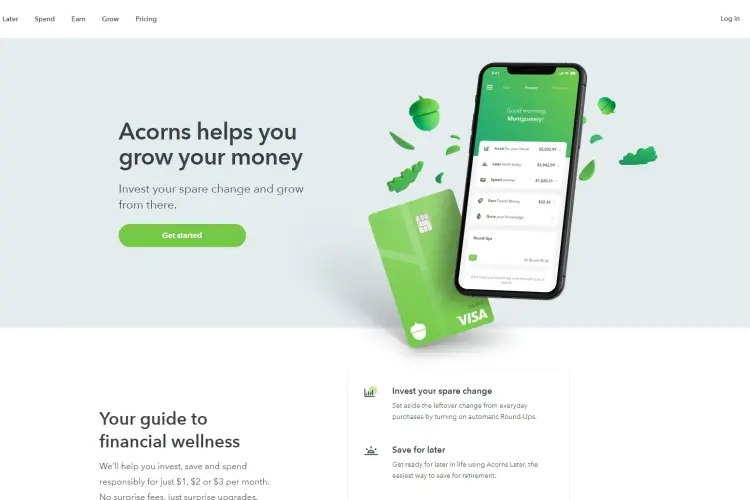

This is an excellent application that helps you to automatically investment the change that is remaining after making purchases through a linked credit or debit card. Acorn's portfolios are built with the help of a Prize winning economist Dr. Harry Markowitz. ETFs which are in portfolio are well structured from some well known investment management organizations. Acorn has received accolades for luring millennial into investing. The company has a market value currently at $860 million. Unlike other investment services such as Betterment and Wealthfront, Acorn is developed basically for mobile devices use. Initially, it was only accessible as iOS and Android application and later, the version for web was launched.

Learn more in the video below

Account features and tools

No minimum amount is required to set up an account and once you have up to $5, investing begins. An ETF portfolio is automatically built using 7 separate asset classes which keeps rebalancing and you can regularly track it. Another feature includes roundups which indicates the change left between your purchases, and the following dollar is approximated on the linked debit or credit card and automatically invested.

Pricing and fees

For accounts with balance less than $1 million, the fees are $1 per month . These fees tends to rise to about $100 each month for all additional invested million. and the fee is actually very low considering ETFs and mutual funds. Nevertheless, if your account balance is very low, this can become a high fee. For example, with $100 in an account, the fee in percentage of asset is as high as 12%. However, the decrease in percentage is with a high account balance. For $10,000 it is 0.12% and for $5,000 the fee is 0.24%. Lastly, moving an investment from Acorn requires a fee of $50 for ETF, this is quite steep compared with other providers.

Features

· College students get free management service

· Change is invested automatically

· Retailers often offers cash back for Acorns account.

Previously know as Tradeking , Ally invest is an arm of a company that deals with some financial services like banking and lending. The service deals with different asset classes, and the company's focus is primarily on providing an easy, affordable and convenient tools mainly for users. This brokerage deals in trading ETFs and stock. They provide the needed investor basics for conducting stock research.

Learn more in the video below

Account Features and tools

Over 500 ETFs that are commission free are provided by Ally. This company has fixed income products and a large mutual fund inventory. Ally also offers cash bonuses that ranges from $40 to max of $3,000 on deposits, and the minimum amount to qualify is $10,000 . Ally is a very useful tool for fund investors because a low fee of $10 is offered for mutual fund purchase via it's service. The best part about Ally invest is that you can set up an account with as low as $1.

Pricing and fees

No charged commission fees for stock trades and regular ETFs on Ally invest. Although, $0.05 is charged for option trades. The fee of $9.95 for mutual trades is lesser than other service competitors. $4.95 is the charge fee for some penny stocks.

Features

· No minimum account balance is required

· Educational and research tools are good

· Digital account opening is quick and easy

· Low fees fod non trading and trading.

This is a huge online broker that offers many platforms that ranges from basic web to advanced platform for active traders. It is joined with scottrade which adds about 3.5 million customers. Ameritrade available for customers for research and for trading are very extensive. It features a very competitive prices for commission and no minimum accounts. It offers a full service brokerage, Mobile Apps and a good customer service. TD Ameritrade was established in the year 1975, this company has over $1 trillion client assets and over 11 million broker accounts. It also offer an immediate customer support service through its chat feature.

Account Features and tools

Ameritrade offers free ETFs of more than 300 and also features a large mutual fund selection of over 12,000. There is also forex trading with over 75 currency pairs that is available for trading. It provides an international exchanges through live broker. Their readable security include bonds, mutual funds, stocks, ETFs, futures, IPOs and forex.

Fees and Pricing

TD Ameritrade commission is slashed from $6.95 to free trading for its options, stock trades and ETFs. However, the options trades carry a charge of $0.65. The charge fee of a broker assisted trade is $44.99.

Features

· Zero commission for stock trades and ETF

· Large selection of investment

· Good customer support

· Extensive research facilities.

About Dan Sullivan

Dan Sullivan is a renowned professor and esteemed education writer with a passion for inspiring students and transforming the field of education. With a diverse background in academia and practical teaching experience, he has become a leading figure in educational research and pedagogy.

|

|

|

|

Check These Out

Let's get FREE Gifts together. There're other Freebies here

AdBlock now to see them all. Click a button below to refresh

|

|

|

|